Navigating the world of taxes can often be daunting for many individuals. Understanding the boons of federal Form 1040, the standard IRS document taxpayers use to file their annual income tax returns is key to this process. It's integral to the tax filing procedure because it's where you report your income, claim deductions and credits, and calculate the amount of taxes owed or the refund due. It adjusts to the complexities of a taxpayer's financial situation, accommodating various sources of income and tax situations.

With the average person in mind, resources like 1040-form-printable.net become invaluable. Our website provides tools designed to simplify preparing your tax return. The provision of a blank printable 1040 form is among its most practical features; it allows taxpayers to have a physical document to review and work on at their own pace. Not everyone is comfortable with digital entries or trusting their sensitive information solely to online platforms, and this printable form meets that preference perfectly.

Moreover, for those ready to embrace technology, the option to fill out the 1040 online is a step toward efficient tax filing. It speeds up the process by providing interactive fields and automated calculations, which can help prevent common errors when completing the 1040 form template by hand. Having such digital aids can make a significant difference in the accuracy and timeliness of a tax submission.

Form 1040 and Filing Status

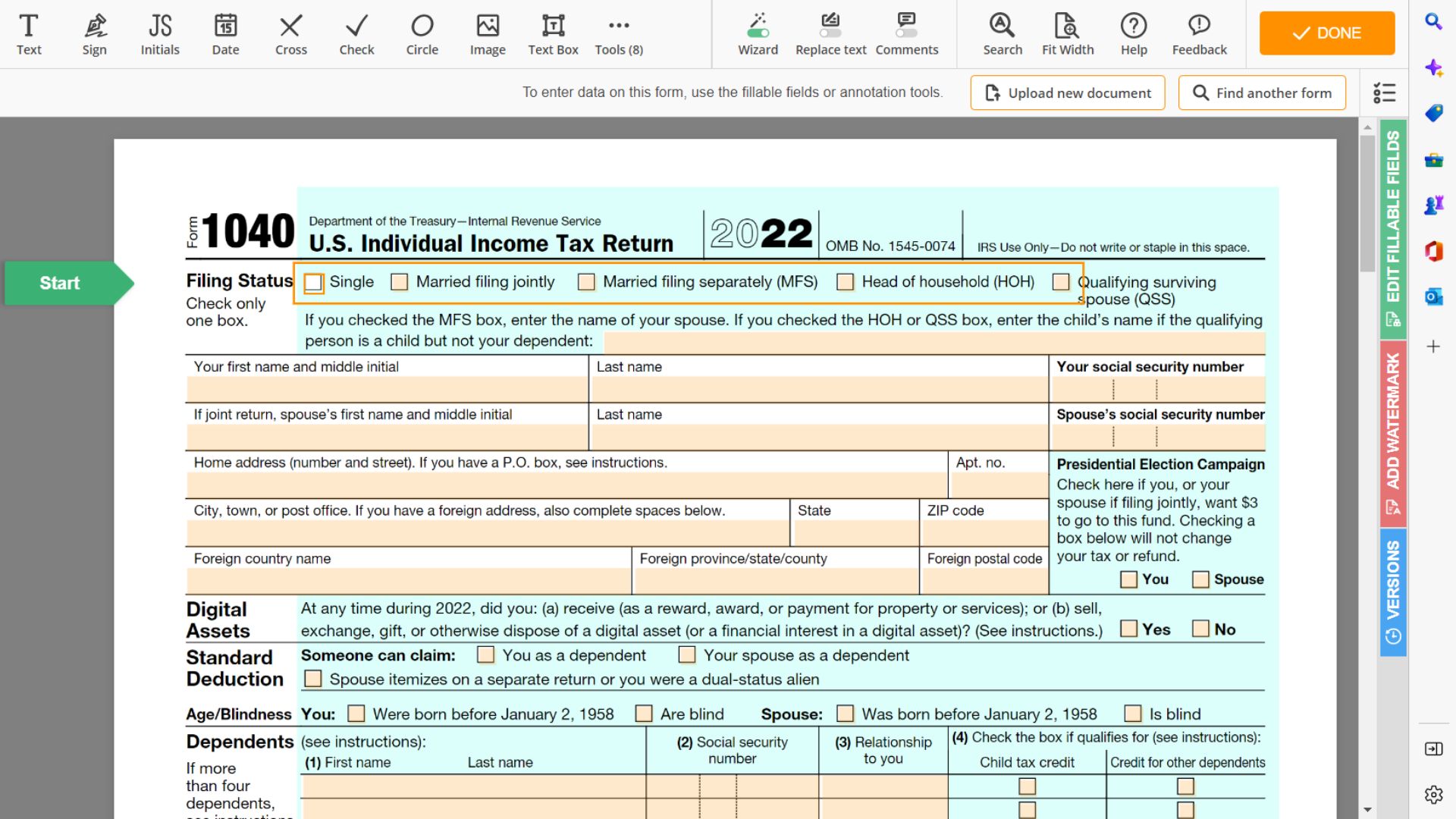

When it comes to filing taxes, the 1040 tax form example is a document with which nearly every income-earning individual in the United States will become familiar. Understanding the free printable IRS Form 1040, its variants, and the applicable filing statuses is crucial for ensuring that your tax return is accurate and filed in the most beneficial way possible.

People can find a free 1040 tax return service online, which guides them through filing without incurring additional costs. To utilize these services effectively, one must first select their filing status, an essential step that impacts the tax rates and determines eligibility for certain deductions and credits.

There are several filing statuses to choose from, and identifying the most advantageous can be influenced by factors such as marriage, dependents, and overall income.

- There’s "Single" for unmarried individuals without dependents.

- "Married Filing Jointly," where couples combine their income and deductions.

- "Married Filing Separately" is an option that might be beneficial if individual deductions would garner a better return than a joint approach.

- "Head of Household" is available for singles who pay more than half the cost of home upkeep for themselves and a qualifying individual.

The 2023 IRS tax form 1040 includes the need-to-know information that helps you understand which status best aligns with your situation. When deciding upon the most beneficial filing status, evaluate both your living circumstances and financial picture from the past year. Taxpayers might find it helpful to consult the 1040 tax form instructions, which offer detailed insights about each status’ qualifications and benefits.

Types of Income to Report on IRS Form 1040

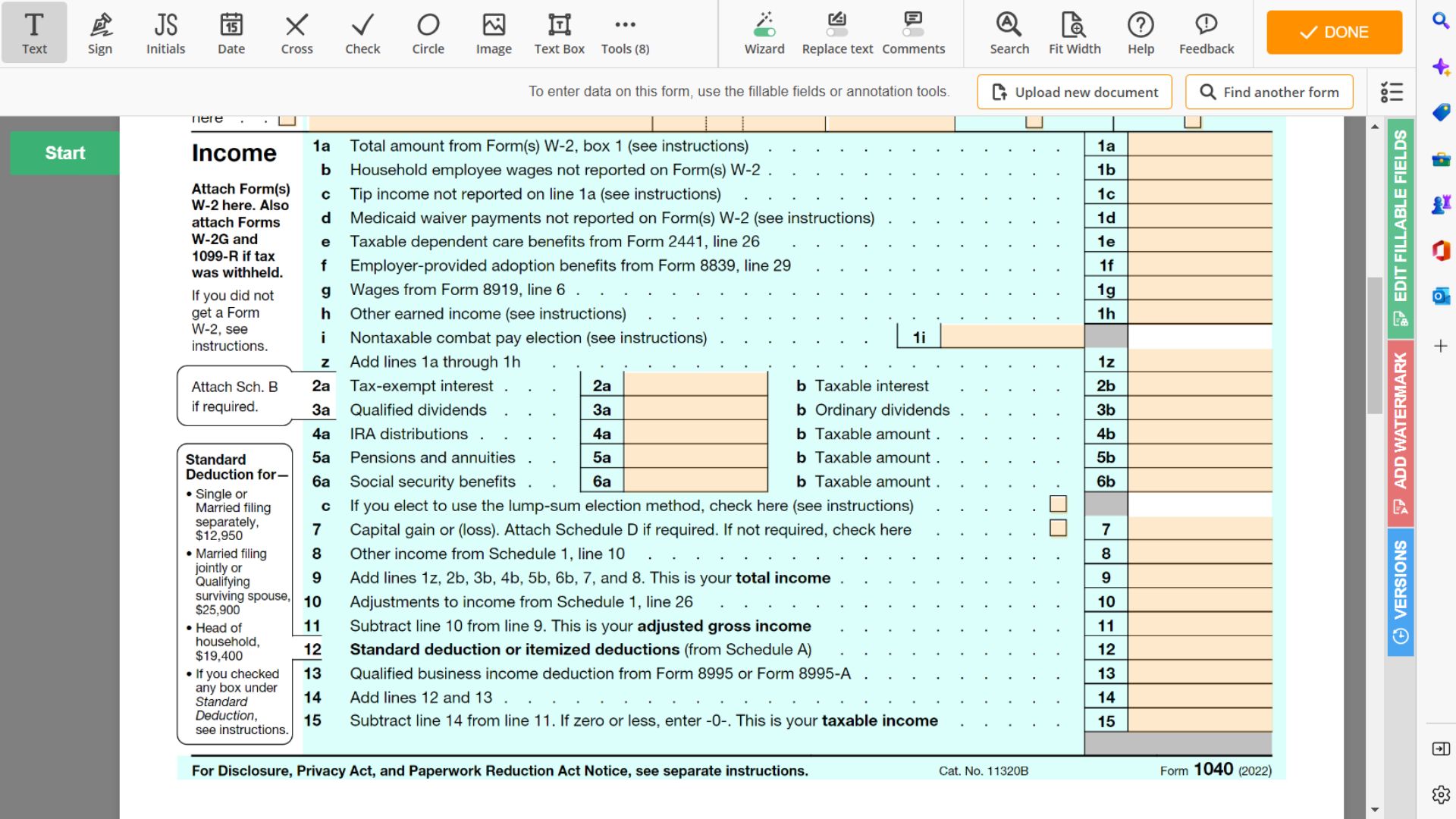

Understanding the intricacies of federal tax form 1040 is crucial for ensuring accurate reporting and compliance with the IRS. This form serves as the standard foundation for individual tax filing, and correctly documenting one's income is the cornerstone of the process. Simply put, the printable tax form 1040 outlines various earnings categories, from traditional wages to more complex investment revenues, each demanding careful attention to detail.

- For most employees, wages earned from a job represent a significant portion of their annual earnings. These figures are usually documented through a W-2 form provided by an employer, which must then be transferred to your tax return. It's important to not overlook any portion of one's salary, bonuses, or other forms of compensation in this reporting.

- For those who run their own business or engage in freelance work, self-employment income constitutes another category that demands disclosure. Individuals are responsible for reporting their net earnings after deducting allowable business expenses. Section C on the blank 1040 tax form will guide you through capturing this information.

- Moving on to other sources, rental income acquired from properties also requires reporting. Whether from residential or commercial estates, the income a property generates, minus the expenses incurred, contributes to your taxable amount. This aspect of tax reporting can get intricate as it involves accounting for depreciation and improvements, which means diligence is necessary when providing these details.

Furthermore, investment income has its reporting nuances. This income might come from dividends, interests, stock sales, or bonds, among other investment vehicles. Each of these copies of earnings has a distinct way of being reported, and some may involve additional forms or schedules attached to the 1040. One can utilize a sample of the 1040 tax form to streamline this process, which provides a reference point for reporting various income types.

Form 1040: Standard Deduction vs. Itemized Deductions

One of the most significant sections of the blank IRS Form 1040 revolves around tax deductions - a pivotal tool for reducing taxable income.

When commencing the printable 1040 tax form filing process, taxpayers often encounter the decision between two primary deduction pathways: the standard deduction and itemized deductions. The former provides a flat reduction in taxable income set by the IRS and varies according to your filing status. Filing for the standard deduction is a straightforward procedure appealing to many due to its simplicity and guaranteed tax benefit.

In contrast, itemized deductions are more intricate, allowing taxpayers to list eligible expenses that often contribute to a greater deduction sum. However, itemizing is detailed and typically pursued by those with significant deductible expenses.

For those meticulous enough to itemize, it is imperative to understand eligibility and requirements for common deductions.

- Mortgage interest can be included if you itemize, provided you meet criteria such as the loan being secured by your home and not exceeding certain limits.

- Student loan interest can be deducted even if you don't itemize, subject to income phaseouts.

- Medical expenses also offer potential tax relief, though they must exceed 7.5% of your adjusted gross income to be deductible.

While some may navigate online platforms to file the 1040 for free, others lean towards tangible documents. The IRS ensures accessibility to these crucial forms. Thus, one can conveniently print Form 1040 from the agency's website.

Tax Credits Available on Form 1040

With tax season upon us, let me guide you through the labyrinth of credits available via the fillable IRS Form 1040, making sure you're well-equipped to maximize your returns for the year 2023.

Understanding and utilizing tax-related credits can significantly decrease your fiscal liability, and the 1040 tax form for download is the gateway to these opportunities.

- The Child Tax Credit, for example, is designed to provide financial relief to taxpayers with dependent children. To qualify, you must meet specific income thresholds and provide the necessary documentation proving your child's age, relationship, and residency requirements.

- Aside from family-related credits, the Earned Income Tax Credit (EITC) is especially beneficial for low to moderate-income earners. To claim this credit, you must file a federal return even if you do not owe any tax or are not required to send, and you must have earnings from employment or from running a business or farm.

- Another area where taxpayers can save is with education credits. These credits are tailored to offset costs associated with higher education, such as tuition and related expenses. You must determine your eligibility for the American Opportunity Credit or the Lifetime Learning Credit, each having distinctive benefits and qualifications.

If you're looking to prepare for the upcoming tax submission, the IRS Form 1040 for 2023 captures all these credits. Reviewing the instructions carefully is crucial to ensure you accurately report your information and claim all that you're entitled to.

For convenience and efficiency, consider using the 1040 online form. This digital version simplifies the submission process and helps you calculate your credits automatically. When dealing with the 2023 Form 1040, ensure all information is current and reflects any updates or changes in the tax law that could impact your potential savings.

Blank 1040 Form: Explanation of the Tax Calculation Process

If this is your first time undertaking this task, or you simply need a refresher, let's walk through the key aspects of the printable 1040 tax return form and how it enables you to determine what you owe to the IRS.

- Firstly, to get started, you'll need to download the 1040 tax form itself. Fortunately, it is available on our website for those who prefer a tangible approach. This can be particularly helpful if you want to familiarise yourself with the layout or work through parts of your tax calculations by hand before transferring them to a digital platform or handing them off to an advisor.

- Within the free printable 1040 form, you'll list all forms of income, encompassing wages, dividends, business earnings, and any other sources you have. After tallying up your total income, you'll then subtract any adjustments, such as contributions to a traditional IRA or student loan interest paid, to arrive at your adjusted gross income (AGI). Your AGI is crucial as it impacts various deduction and credit thresholds.

- The process continues as you subtract either the standard or itemized deductions from your AGI, resulting in your taxable income. You'll apply this figure against the tax brackets to ascertain what you owe.

Understanding tax brackets is essential since they are structured progressively, meaning portions of your income are taxed at increasing rates as your earnings rise. Each bracket on the 1040 form example corresponds to a specific income range and is taxed at its rate.

Federal Form 1040: Common Issues & Solutions

| Common Errors | Tips to Avoid Mistakes |

|---|---|

| Many individuals discover that misunderstandings about income reporting can lead to inaccuracies on their federal tax return form 1040. This can happen when all sources of income, such as dividends or interest from investments, aren't included. | Before you begin, collect all necessary documentation that details all income received over the past year. Review every document thoroughly to ensure no income is overlooked. |

| Miscalculating deductions and credits is another frequent issue. This can occur due to simple mathematical errors or misunderstanding tax laws. | Using tax preparation software can automate calculations and reduce the potential for error. If you fill out the 1040 form by hand, double-check all math with a calculator. |

| Incorrectly entered Social Security numbers can derail the entire filing process, leading to delays in processing and potentially affecting dependent claims. | Triple-check every Social Security number on your return against the actual Social Security cards to verify accuracy. |

| When reviewing a sample of the 1040 tax return for educational purposes, take note of the frequency with which filers choose the wrong filing status – this choice can greatly impact your fiscal obligations and benefits. | Assess your situation carefully to determine the appropriate filing status. If uncertain, consult with a tax professional who can guide you in making the correct selection. |

| Failure to sign and date the return is a simple oversight that can invalidate your submission, even if you print the 1040 tax form correctly and everything else is in order. | Always sign and date your return. If filing jointly, ensure both spouses sign. The IRS considers an unsigned tax return as incomplete. |

| Electronic filers occasionally make the mistake of overlooking the opportunity to use a free fillable 1040 tax form, which aids in reducing manual input errors. | Research the IRS Free File program or other approved electronic filing options that offer guided assistance and error-checking features. |

Remember that paying attention to the details and taking time can save you from making these common mistakes. Getting familiar with the requirements to file the 1040 tax return and staying up-to-date with any changes in federal laws will also contribute to a smooth and accurate filing experience.

Due Date to File Form 1040 for 2023

Familiarizing oneself with the filing deadlines to fill out Form 1040 is essential to ensure compliance and avoid unnecessary penalties. Typically, April 15 is the date etched in the minds of taxpayers as the deadline to submit their tax returns. However, if this day falls on a weekend or a public holiday, the deadline is pushed to the next business day.

For many, modern technology has simplified the process of filing taxes. Individuals can e-file the 1040, which is both convenient and efficient. Filing electronically not only saves time but often results in quicker processing of refunds as well. Those who prefer a digital method but still like to see things on paper before submitting can download Form 1040 in PDF format. This option allows taxpayers to review their entries carefully, ensuring accuracy before transmitting their information online.

Failing to file a copy of the 1040 form on time can result in penalties and interest accruing on any amount owed. These consequences underscore the importance of either filing on time or understanding how to properly request an extension. Taxpayers who require additional time to gather their documents and fill out their returns can file Form 4868 for an automatic six-month extension. Remember, this extension applies to the filing of the paperwork, not an extension to pay any taxes due, which are still expected to be paid by the original April deadline to avoid late payment penalties.

2023 Form 1040 - Instructions

2023 Form 1040 - Instructions

How to Fill Out a Form 1040

How to Fill Out a Form 1040

Form 1040 Guide

Form 1040 Guide

Step-by-Step Guide on Filling Out Form 1040

Step-by-Step Guide on Filling Out Form 1040

IRS Form 1040 & Its Alternatives

IRS Form 1040 & Its Alternatives